Almost 15 million Australians covered by private health insurance will be paying more for their premiums, which are set to rise by more than three per cent on average – the largest increase in five years.

On Tuesday, the Albanese government approved an industry average premium increase of 3.03 per cent, effective April 1.

Customers at the nation’s largest private health fund, Medibank Private, will see average premiums jump by 3.3 per cent, while Bupa will jump by 3.6 per cent. A four per cent hike has been signed off for HSF, and NIB’s premiums will rise by 4.1 per cent

Policyholders with Tasmania-based Health Care Insurance will be hit with the smallest increase in their average premiums, up just 0.3 per cent, while CBHS Corporate Health members will be stung with a 5.8 per cent rise.

The 3.03 per cent figure is not an average of the premium rises of the policies offered by insurers but measures the percentage increase in premium income health funds receive.

Health insurers are permitted to increase premiums annually, however, the health minister must approve any rise.

The decision comes after several months of negotiations, which prompted industry concerns the decision was being delayed until after last Saturday’s Dunkley by-election, which the Albanese government retained despite voter discontent over the rising cost of living.

In December, Health Minister Mark Butler blocked requests by the country’s 31 health insurers for increases of up to six per cent, forcing many firms to resubmit their proposals.

In a statement released on Tuesday, Minister Butler said he wasn’t prepared to just “tick and flick” the premium increases proposed by health insurers.

“I asked insurers to go back and sharpen their pencils and put forward a more reasonable offer for the 15 million Australians with private health insurance,” Mr Butler said.

“Private health insurers must ensure their members are getting value for money.

“When costs rise, Australians want to know that higher premiums are contributing to system-wide improvements, like higher wages for nurses and other health workers and ensuring that affordable services are available.”

The annual premium increase, Mr Butler added, was outstripped by the annual rate of wages growth and inflation, the benchmark for changes to social security payments.

About 55 per cent of Australia’s population is covered by private health insurance, with the cost partly subsidised by government via a tax rebate which reduces as a policy holder’s income grows.

In the past year, more than $23.5bn in health and medical benefits were paid out to policy holders by health insurers.

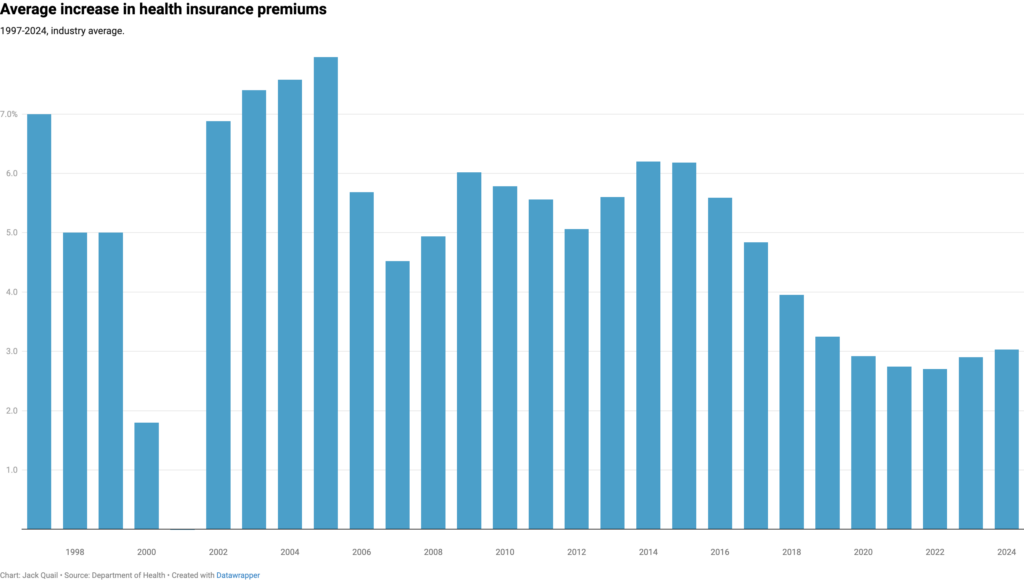

Health insurance premiums have risen fairly modestly in recent years, climbing by 2.9 per cent in 2023, and by 2.7 per cent in both 2022 and 2021.

An investigation by the competition watchdog released in December found the industry’s net-profit after tax surged 110 per cent to almost $2.2bn in the 2023 financial year, up from $1bn in the 12 months prior.

The Albanese government will also provide $7.3bn this year to Australian policy holders through the private health insurance rebate, and will work to reduce the cost of medical devices like insulin pumps.

Do you have an idea for a story?Email [email protected]

Aged Care Insite Australia's number one aged care news source

Aged Care Insite Australia's number one aged care news source